Break Through the Subscription Wall: Know Your Company’s Growth Ceiling

Understand how to calculate your company’s growth ceiling with a few quick metrics and avoid or break through the subscription wall.

I offer consulting services and can help you think through challenges surrounding growth strategy, pricing, retention, unit economics, and more. Learn more.

Mike Salguero, Founder and CEO of ButcherBox (a grocery delivery service that provides high quality meats, poultry, and seafood) wrote a fantastic thread on what he calls the “subscription wall”.

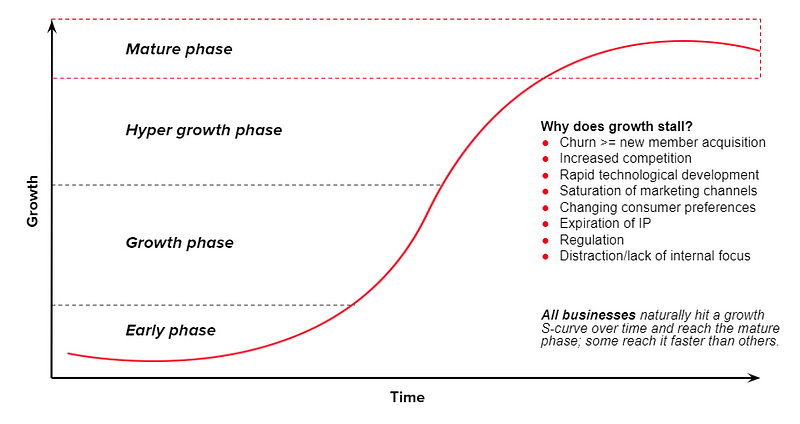

What he is referring to is when your company’s growth stalls and hits the top of the S-curve, a deadly phase in the lifecycle of a startup and a phenomenon I have written about previously here. In this post, I will simplify this concept to help you calculate your growth ceiling with a few quick metrics. By investing proactively into growth and retention initiatives, you can raise the ceiling and avoid the subscription wall or what I call the “oh shit” moment.

Illustrating the Growth Ceiling

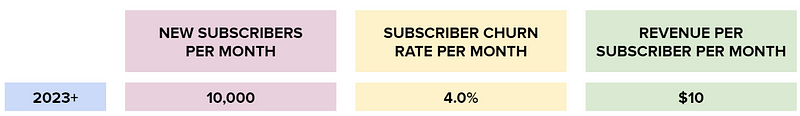

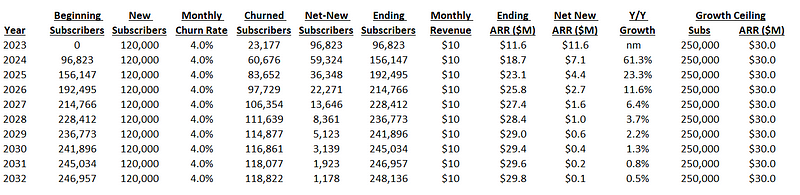

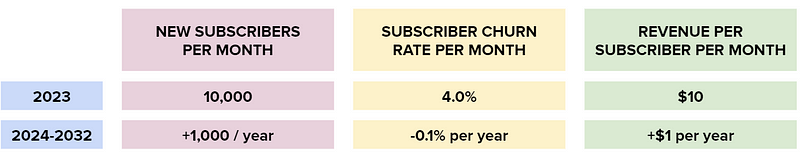

We can isolate Company A’s growth potential into three simple metrics, defined below: new subscribers, churn rate, and revenue per subscriber. Let’s also go ahead and make a few starting assumptions:

Company A adds 10,000 new subscribers per month that pay, on average, $10 per month ($120 per year). The company loses 4.0% of its subscriber base each month to churn.

Early Growth (First 12 Months)

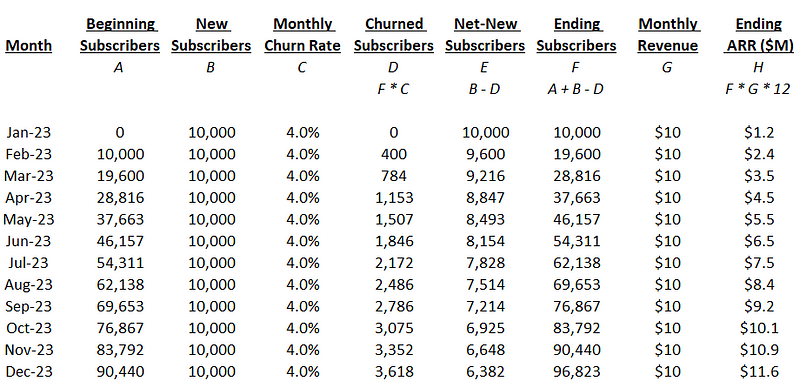

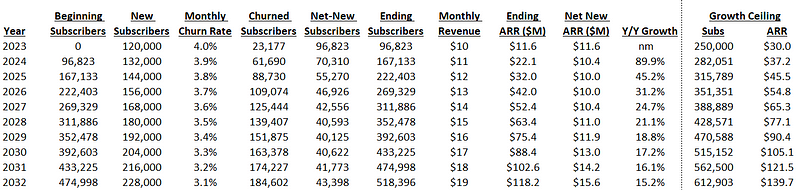

Below you can see a detailed table of the first year of operations for Company A by month:

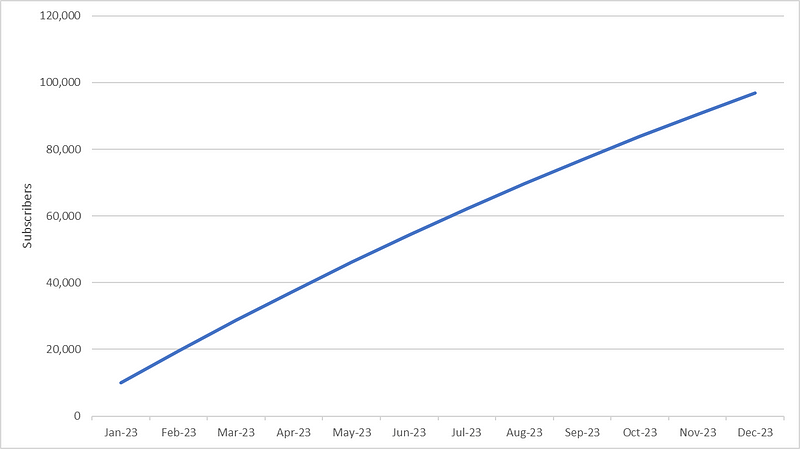

Company A went from 0 to almost 100,000 subscribers in only 12 months, while growing Annual Recurring Revenue (ARR) to $11.6M! This is really impressive hyper-growth. Below you can see it visually and it looks like almost a straight line.

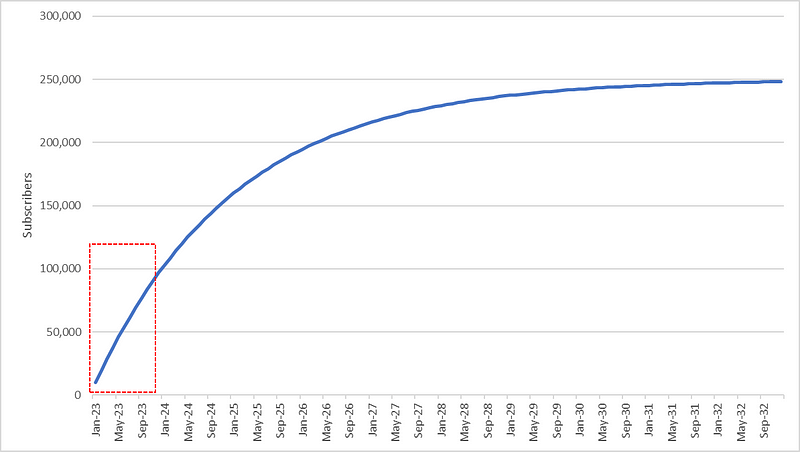

Longer-Term Growth

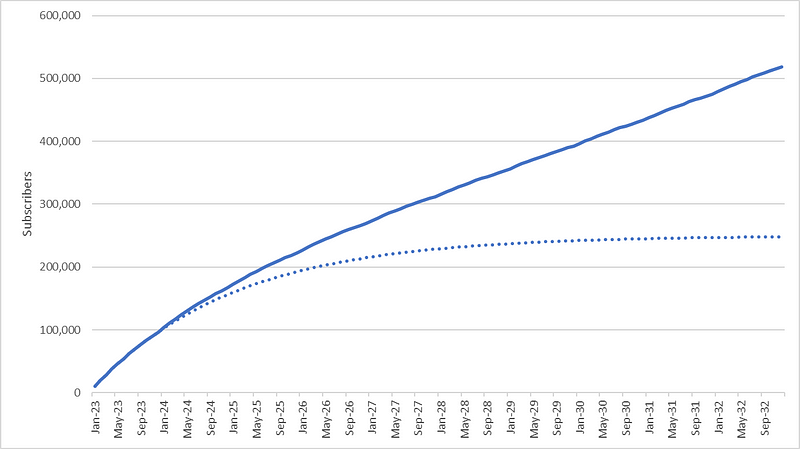

Now let’s elongate the subscriber curve and look over a longer-time horizon. I’ve boxed the portion that was illustrated in the chart above for perspective. What do you see?

Company A starts to see its growth curve slow until it hits the “subscription wall” after a few years. Even though the company adds ~100,000 subs in the first year, it only adds 150,000 over the next 9 years. The company’s growth ceiling is around 250,000 subscribers.

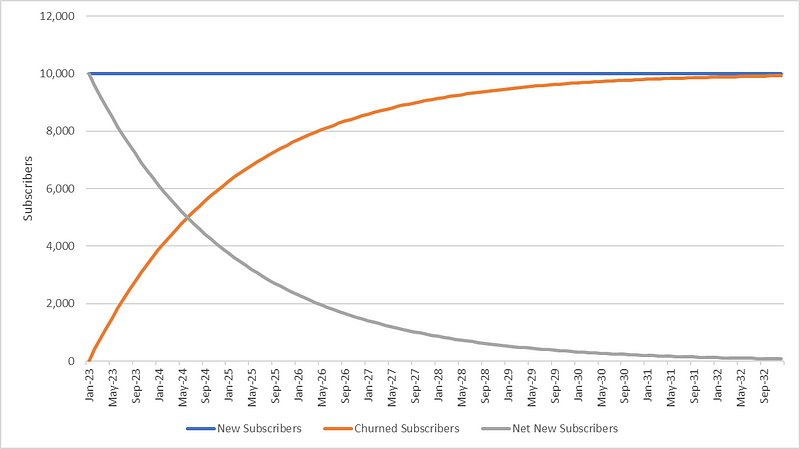

The Power of Compounding Churn

While Company A was consistently adding 10,000 new subscribers per month, the 4.0% churn was starting to eat away at a larger and larger base of subscribers every month. Thus, the number of “net new” subscribers (new subs minus churned subs) being added each month was declining until it reached zero, stalling Company A’s growth.

The story is easily summarized when looking at annual figures. Year-over-year ARR growth stalls to the single digits in just a few years. Ouch…

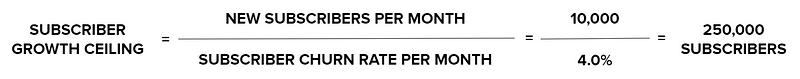

Calculating the Growth Ceiling

The growth ceiling can be calculated by a very simple formula, shown below. The assumption is that the key metrics (new subs, churn, and revenue per sub) stay constant going forward.

To convert the growth ceiling into a revenue figure, simply multiply the subscriber figure by the monthly or annual revenue generated per subscriber. In the case of the company above, $120 per year equates to an annual recurring revenue amount of $30M (250K * $120).

Below is a spreadsheet model that my colleague Sam Bauman and I created to enable you to easily plug in and visualize your own figures:

Growth Ceiling Calculator.xlsx

www.dropbox.com

How to Raise the Growth Ceiling?

Now that you know how to calculate the growth ceiling, how do you go about raising the ceiling? In the simplest financial terms, the three ways to raise the growth ceiling are to:

Increase new subscribers per month

Decrease monthly churn

Increase revenue per subscriber

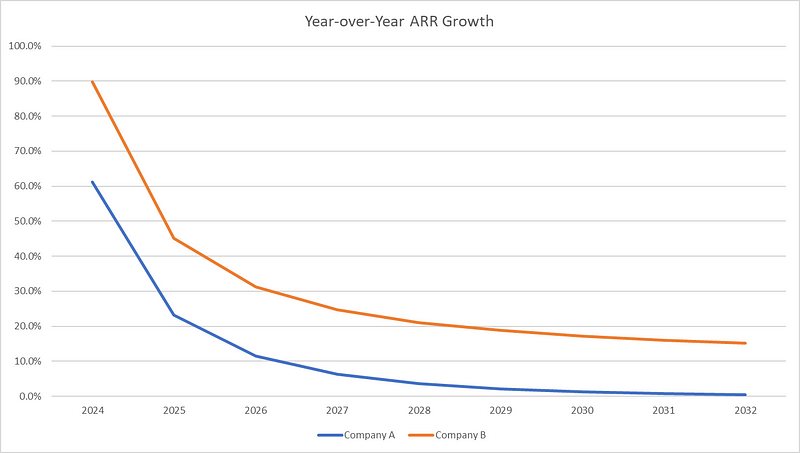

Let’s go back to our original example and make a few tweaks, calling this Company B. This company increases its new subscribers per month added by 1,000 additional subscribers every year, reduces churn by 0.1% more every year, and increases its revenue per subscriber by an extra $1 every year.

While these changes look small, together they compound to continually raise Company B’s growth ceiling over this ten year horizon. So while the number of churned subscribers continue to increase, it does so at a decreasing rate, with the new subscriber count increasing as well, offsetting the stalling growth that we saw with Company A. By the end of the same period, while Company A tapped out at 250,000 subscribers, Company B was able to over double its subscriber count to 500,000 during the same time period, with a more linear and durable growth curve.

What is the New Growth Ceiling?

By improving its core metrics each year, Company B was continually raising its growth ceiling. You can see that by 2032, the company has a growth ceiling of over 600,000 subscribers and close to $140M ARR.

Comparing the Two Companies

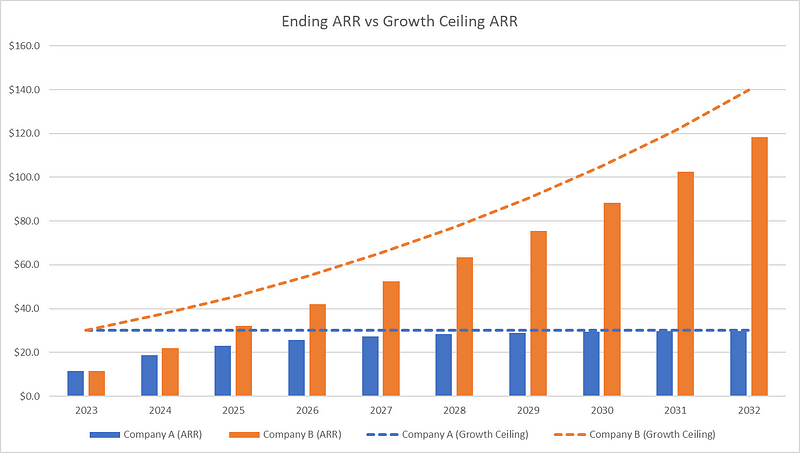

As you can see below, in the first year, both companies had the same ending ARR and growth ceiling. They each had visibility into $30M of total ARR.

After year one, Company A didn’t improve its metrics and its growth ceiling stayed constant going forward. As a result, its ARR growth tapped out after just a few years. Company B, on the other hand, invested to improve its core metrics and thus raised its growth ceiling each year. By 2032, not only is Company B over 4x the scale ($120M vs $30M), it has visibility into additional growth as well.

Having said all this, even though Company B has higher growth potential, it is still only growing at 15% in the later years. For the company to drive real sustained 30%+ growth it will need to move these metrics even more, but continually moving these metrics will become challenging at scale.

If you notice growth slowing, it is tempting to invest in the mature growth engine (e.g. buying Facebook ads) to re-energize growth. This is a common trap, however, as this is the easiest path forward given the maturity of the engine and these efforts are often expensive. Make sure to think hard about the ROI of each initiative that can move these metrics. Durable growth ultimately comes from flattening retention cohorts. I have written about this extensively and you can read more here.

In the short term, growth comes from acquisition but in the long term, growth comes from retention

Strategies to Raise the Ceiling

Companies are able to move the three key metrics in a variety of ways. Here are a few common examples:

Selling via new sales channels (increase new subscribers)

Expanding to new geographies (increase new subscribers)

Launching new products or business lines (increase new subs, decrease churn, increase revenue per sub)

Upselling existing customers (increase revenue per subscriber)

Expanding up/down market (increase revenue per subscriber)

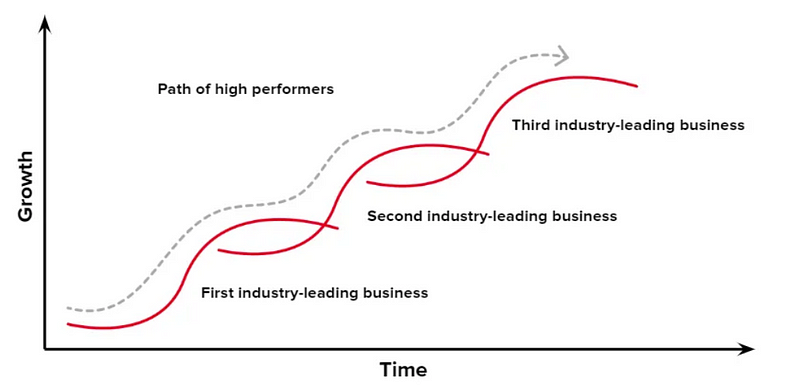

Successful execution is due to many factors including timing, proper resourcing, responding with the right strategy in face of the particular headwind, and taking advantage of your company’s unique strengths. High performing companies are able to continually raise the ceiling of growth over many years via new initiatives. Starting to think about your next growth driver when sales in your core growth engine are starting to flatten is way too late. Once gravity takes hold, it’s very hard to reaccelerate the growth of the business.

Conclusion

S-curves and growth ceilings are not intuitive but are hugely important for management teams to understand in order to navigate the complexities of company scaling. In order to achieve sustained, long-term growth it is imperative to continue to embrace innovation. Hopefully with this framework, you can break through the growth wall, turning “oh, shit” to “oh, yeah”.

Additional Reading

Lessons on a few failure modes related to S-Curves and re-energizing growth (LINK)

Deeper dive into retention and the importance of flattening retention curves for growth (LINK)

Consumer subscription benchmarks, particularly monthly retention and engagement (LINK)

Special thanks to my colleagues Sam Bauman and Ben Katz for their contributions to this post.

Interested in going deeper? I offer consulting services and can help you think through challenges surrounding growth strategy, pricing, retention, unit economics, defining your a-ha moment, and more. Learn more.