From Habits to Networks: The Power of Increasing Real Product Value

In this post I dive deeper into real product value and strategies that companies can take to drive increasing value over time.

I offer consulting services and can help you think through challenges surrounding growth strategy, pricing, retention, unit economics, and more. Learn more.

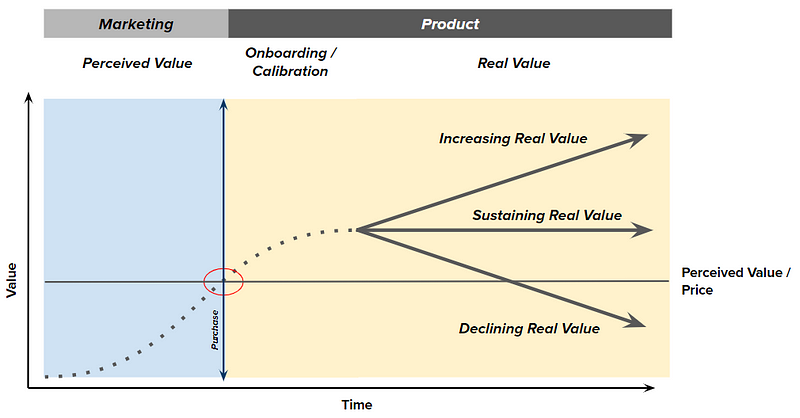

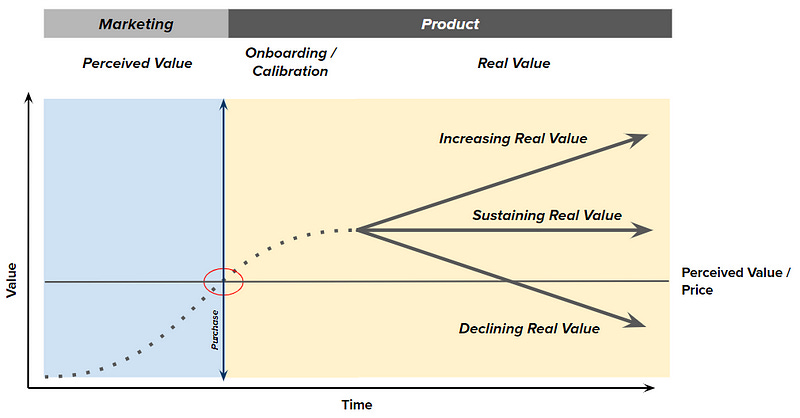

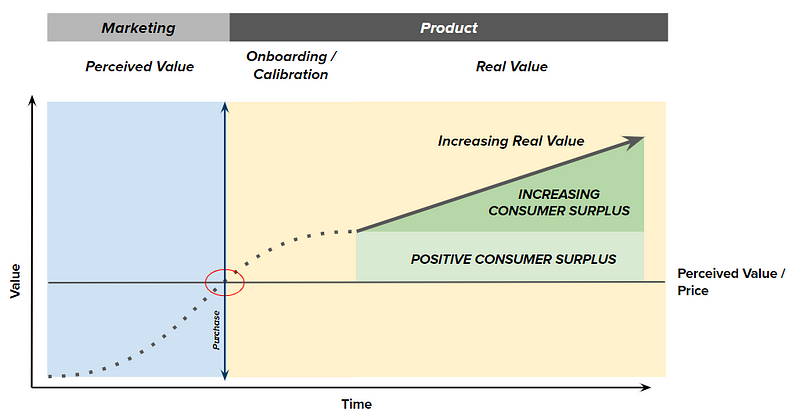

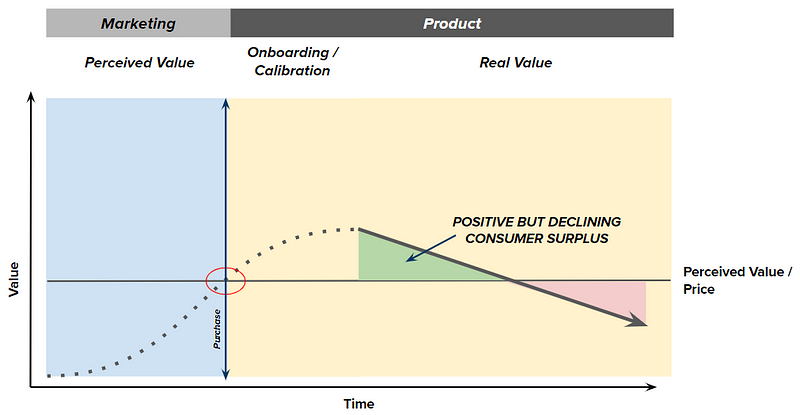

My last post discussed the difference between perceived value and real (product) value. I illustrated real value as sustaining over time, but this may not always hold true. Depending on the product experience, a company’s real value can either increase or decrease over time, having large implications on retention and long term growth.

Increasing Real Value

Companies that demonstrate increasing real value over time create a virtuous cycle where the product becomes increasingly difficult to leave, fostering customer loyalty and retention, and driving long-term engagement. This happens because as the consumer uses the product more, it becomes more valuable and the company is increasing consumer surplus.

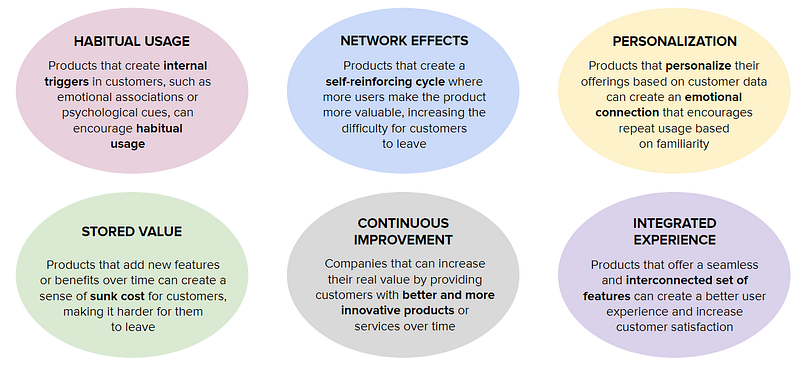

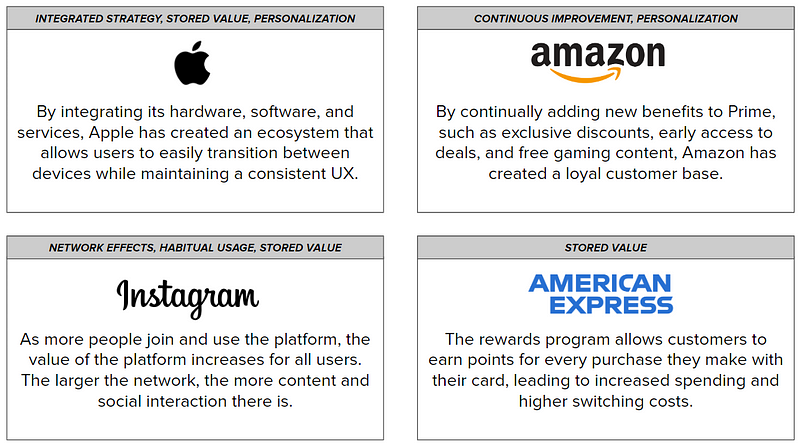

When a company provides a product or service that offers consistently more value to its customers the longer they engage, it creates a strong foundation for retaining those customers over time. This is when you see flattening retention curves. Below I include six of the most common ways that companies can create increasing real value over time.

Real-Life Examples

To crystallize this more in your mind, below are a few examples of what increasing real value can look like for top-tier brands. It is no surprise that each of these brands has high customer loyalty and retention.

When looking specifically at social products, the A16Z consumer team wrote a great post that highlights what great retention looks like. Each of these platforms has scaled to hundreds of millions of daily users. They all nail increasing real value via habitual usage, network effects and stored value.

Decreasing Real Value

Companies that fail to provide increasing value over time risk creating a vicious cycle where customers feel less satisfied with the product or service, leading to decreased loyalty, retention, and long-term engagement. This can be caused by a few factors:

Diminishing Returns: If a product or service fails to provide increasing value with each use, customers may begin to feel that it is no longer worth the cost or effort to use it. This can lead to a decline in engagement and loyalty, as well as an increase in churn. For example, if a subscription-based product offers limited features and fails to add new ones, customers may eventually lose interest and cancel.

Changing Customer Needs: If a company fails to adapt to changing customer needs or preferences, customers may seek out alternative products or services that better meet their needs. For example, Blockbuster failed to adapt to the rise of streaming services and ultimately went bankrupt.

Increased Competition: Increased competition can diminish real product value by leading to price wars, compromised quality, diverted focus, and a lack of product differentiation. For example, Netflix continues to add original content which offsets diminishing returns that come with competitors offering the same features and comparable content.

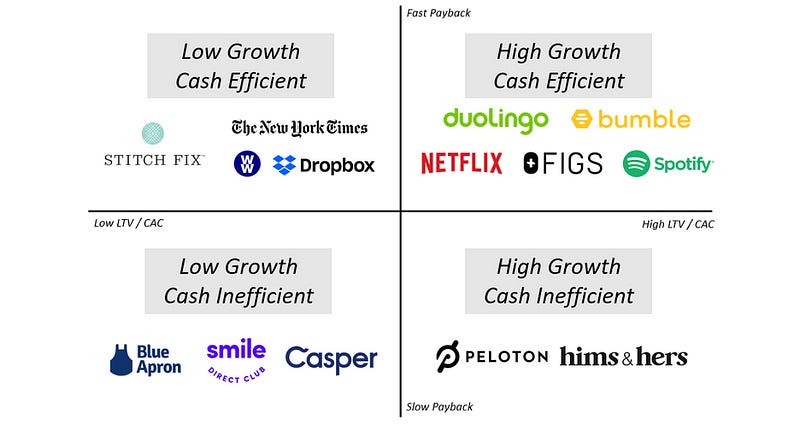

When a company’s real value proposition declines, it can lead to high churn and stalling growth. Customers will churn as soon as they deem their consumer surplus is negative, which happens when real value falls below price. I’ve written previously here about the “danger zone” of companies that are low growth and cash inefficient. These companies are often underpinned by large marketing investments against a diminishing product value proposition.

Many direct-to-consumer businesses have struggled for this exact reason. Investing heavily in customer acquisition against high churn rates that offset those gains. In general, stock performance of consumer brands is down 85–90% over the last couple years.

Conclusion

To succeed in a competitive market, companies must have a deep understanding of both perceived and real value and apply the appropriate pricing model that aligns with those values. It is crucial to acknowledge that both perceived and real value are dynamic and can differ from customer to customer, depending on their evaluation of the product or service.

Depending on the product experience, a company’s real value can either increase or decrease over time, having large implications on retention and long term growth. A company’s ability to deliver sustaining or increasing real value to customers depends on its agility to adapt and innovate quickly. As customer needs and preferences evolve, companies must adapt their products and services to match those changes. Companies that continuously innovate and offer new value propositions to their customers will remain competitive in the market and drive long-term growth.

If you want to delve further into the contents of this post or explore related topics, feel free to schedule a consultation with me by booking time here.

Interested in going deeper? I offer consulting services and can help you think through challenges surrounding growth strategy, pricing, retention, unit economics, defining your a-ha moment, and more. Learn more.