No Moat? Big Problem: The Impact of Industry Forces on Value Capture

In this post I go deep on the critical market forces that influence a company’s ability to create and capture value.

I offer consulting services and can help you think through challenges surrounding growth strategy, pricing, retention, unit economics, and more. Learn more.

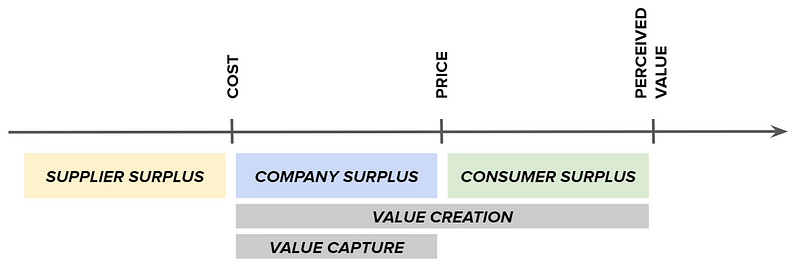

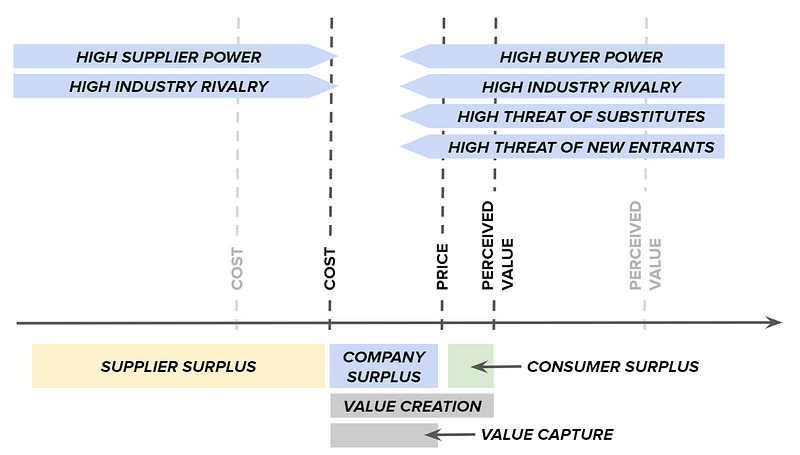

I wrote a post previously that illustrated various pricing strategies and the key principles to help think about value creation and value capture. As shown below, the gap between cost and perceived value is considered as value creation. The gap between the price and cost is considered as value capture.

With these levers in mind, I highlighted three profit enhancing tactics — raising prices, increasing perceived value, and lowering costs. In this post, I will go into further detail to better illustrate the market forces that influence a company’s ability to actually improve these levers. This will help you better understand the attractiveness of your market.

The Key Market Forces

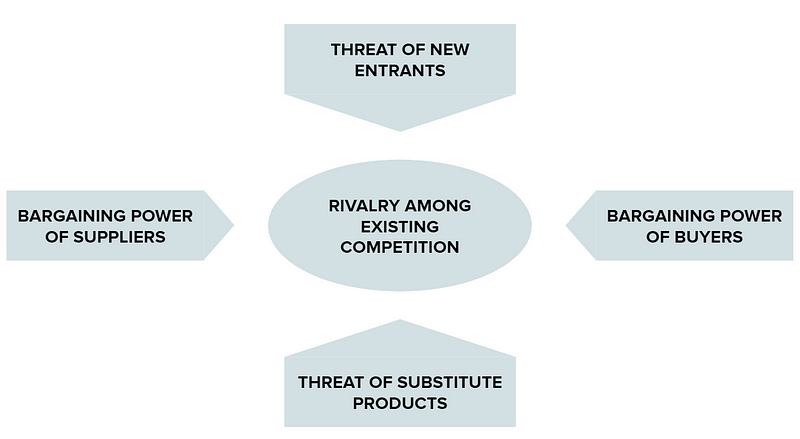

Porter’s Five Forces is a framework developed by Harvard Business School professor Michael E. Porter to help analyze a company’s competitive environment and profit potential. We’ll dive into each of the five forces below and then show how this impacts both the ability to create and capture value for a given industry.

Rivalry Among Existing Competition

The intensity of rivalry among existing competitors directly impacts the competitiveness of an industry, as it affects pricing, marketing, and the product development of companies in the industry. High rivalry can lead to increased competition, lower profits, and a focus on short-term goals. The main determinants of rivalry include the number and size of competitors, the level of differentiation among products, and the industry growth rate.

In competitive industries, companies must continually innovate to remain relevant. This is why tech companies often invest aggressively into research & development, marketing, and finding new distribution channels. Intense rivalry can also lead to price wars and a decline in industry profits. It is important to strike a balance around competing aggressively and ensuring long-term profitability. For more on different pricing strategies, see my previous post here.

Threat of New Entrants

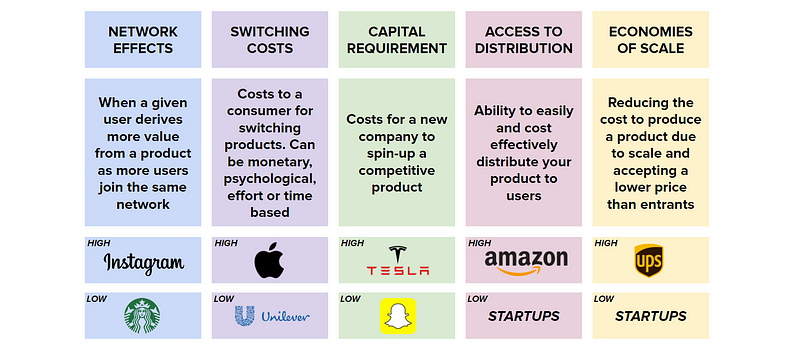

New entrants put pressure on organizations to maintain their market share. The less time and money it costs for a new company to enter a specific market, the more susceptible a company is to a weakened market position. Companies can shed off the threat of new entrants by creating high barriers to entry or “moats”.

A moat is an intrinsic characteristic that gives the business a durable competitive advantage — Charlie Munger

Apple recently launched Apple Pay Later, which lets users split purchases into four payments, spread over six weeks, for no additional fees or interest. This product is similar to core offerings from Affirm, Klarna, and others. It will be interesting to see how defensible these offerings are in their current form. A few thoughts from me below on the potential impact of this launch:

Distribution: Apple has a large user base, and this launch will allow them to offer BNPL services to their existing users without requiring them to sign up for a separate service. This could make it more challenging for other BNPL providers to acquire new users. Distribution is king!

Brand recognition: Apple is a well-known and trusted brand, and the launch, on the other hand, may help to legitimize the BNPL industry in the eyes of consumers who may have been hesitant to use these services in the past. This could benefit Affirm, Klarna, and others by increasing awareness and acceptance of the concept.

Differentiation: Apple Pay Later offers some unique features that could make it more attractive to users than other BNPL providers. For example, Apple Pay Later integrates with the Apple Wallet, making it more convenient for users.

Bargaining Power of Suppliers

Supplier bargaining power refers to the ability of suppliers to influence the terms of the products and services they offer to buyers. This includes raw materials, components, labor, and service. Strong supplier bargaining power can drive up costs while weak bargaining power can lead to lower quality products. It is critical to understand the level of leverage suppliers have in order to negotiate favorable terms and ensure a consistent supply of raw materials.

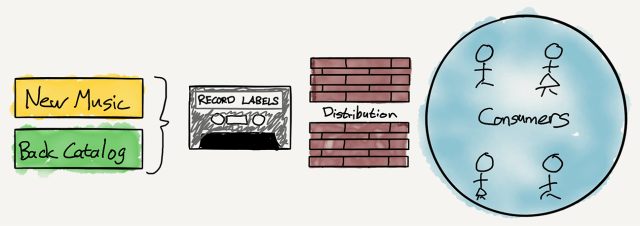

The music industry is known for having high supplier power. Spotify, as a leading music streaming platform, faces challenges due to the high supplier power of record labels, recording artists and songwriters. Despite their scale, suppliers are able to demand favorable terms and royalty rates for their work. Ben Thompson has a great post where he goes into detail on this.

Bargaining Power of Buyers

The power of buyers is a factor of how many buyers there are in an ecosystem, how significant each customer is for a given company, and how much it would cost to acquire a marginal customer. With high buyer power, customers are able to put a company under pressure or negotiate favorable terms.

The bargaining power of buyers can also change over time, as market conditions and industry dynamics evolve. For example, the rise of e-commerce has given consumers more bargaining power in many industries, as they can easily compare prices and product offerings from many different suppliers.

Threat of Substitute Products

Substitute products are those that are not direct competitors but help fulfill the same customer need. For example, airlines and trains are substitute services that help meet the same need of getting from point A to point B. When many substitutes exist, firms face pressure on pricing and quality, as customers have a variety of options in getting their needs met.

Impact of Forces on Profitability

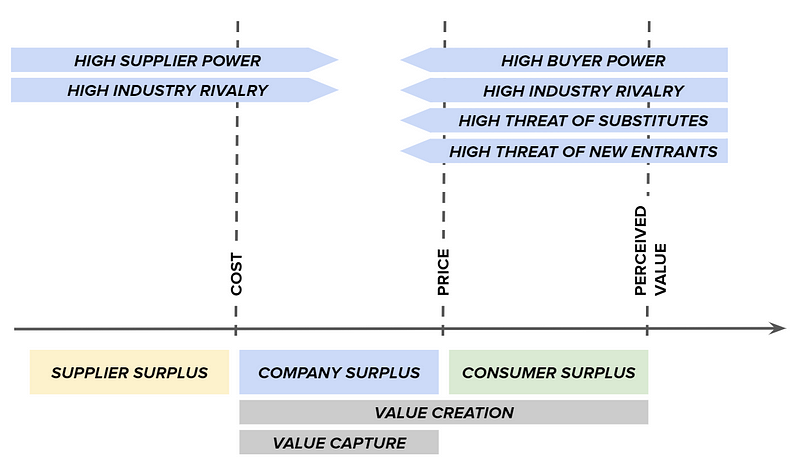

Understanding these forces and how they apply to your industry is critical as it can enable you to adjust your business strategy to better use resources to create and capture value accordingly.

As shown below, high supplier power and industry rivalry are market forces that can increase costs. Conversely, high buyer power, industry rivalry, and high threats of substitutes/entrants are market forces that can reduce perceived value and prices.

Let’s assume you were in an industry that was feeling pressure from each of these forces. As a result, costs are increasing and perceived value is decreasing. This puts pressure on the company and reduces both the value created and captured.

Other Relevant Factors

There are several other factors to keep in mind when evaluating a company’s strategic position:

Industry growth rate: Rapid industry growth can seem attractive but it can also attract new industry entrants, especially if barriers to entry are low and suppliers are powerful.

Technology and innovation: Technology creates opportunities but also has its own limitations. For specific industries (direct-to-consumer retail), technology may not be able to create a desirable customer experience in that customers can’t physically test products. Companies are getting around this with retail strategies and looser trial terms.

Government: Companies with patents can raise barriers to entry. Similar, companies can generate high supplier power through union favoritism from government policies.

Special thanks to my colleagues Sam Bauman and Ben Katz for their review and feedback on this post.

Interested in going deeper? I offer consulting services and can help you think through challenges surrounding growth strategy, pricing, retention, unit economics, defining your a-ha moment, and more. Learn more.