The True Measure of Value: Moving Beyond Perceived Value to Real Value

I dive into the concept of perceived value and introduce the related concept of real value, which is crucial for sustainable growth.

I offer consulting services and can help you think through growth strategy, pricing, retention, unit economics, and more. Learn more.

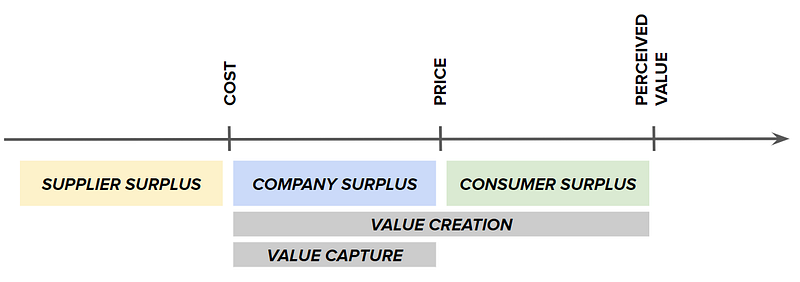

In a previous post, I discussed three fundamental principles of pricing: perceived value, price, and cost. In this post, I will dive deeper into the concept of perceived value and introduce the related concept of real value, which is crucial for determining the sustainable potential of a business. By understanding the difference between perceived and real value, companies can make better pricing decisions that lead to increased customer satisfaction and loyalty, as well as long-term growth.

Perceived Value

Perceived value refers to how customers assess a product or service in terms of its ability to satisfy their needs and expectations. Essentially, it reflects their willingness to pay. Customers make purchasing decisions based on the balance between the perceived value and the price of the product. In order for a customer to make a purchase, they must perceive that the value of the product equals or exceeds its price; otherwise, they have a negative consumer surplus.

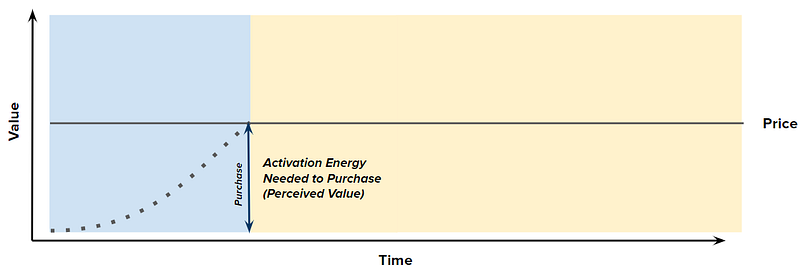

The marketing function has the most direct hand at attempting to influence a product’s perceived value, by emphasizing the product’s qualities to prospective customers. In the process of making a purchase decision, customers encounter advertisements, product reviews, peer recommendations, and testimonials, which act as catalysts to increase the perceived value of the brand. These catalysts lower the activation energy required for customers to make a purchase, as they provide information and social proof that make the decision-making process easier and more favorable towards the brand.

The higher the price of the product, the more activation energy required for a customer to justify the purchase, leading to a higher perceived value needed. This also creates a greater amount of consumer surplus that is “at risk” if the customer is ultimately dissatisfied with their decision. Therefore, high priced purchases are highly “considered” as consumers engage in a careful evaluation of the perceived value against the cost, considering the catalysts that have influenced their decision-making.

Real Value

Real value refers to the actual (calibrated) value that a product or service provides to customers, beyond just the perception of its value. While perceived value is influenced by factors such as marketing and branding, the product itself plays a key role in shaping the real value. Ultimately, for a customer to continue using a product or service, their assessment of its real value must meet or exceed its price, or else they may experience a negative consumer surplus and cancel / churn.

Putting It Together

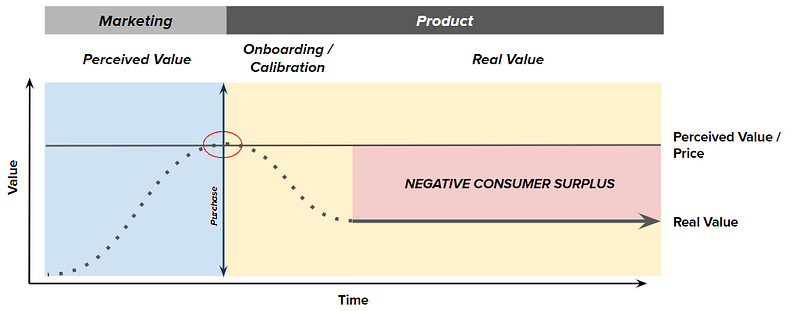

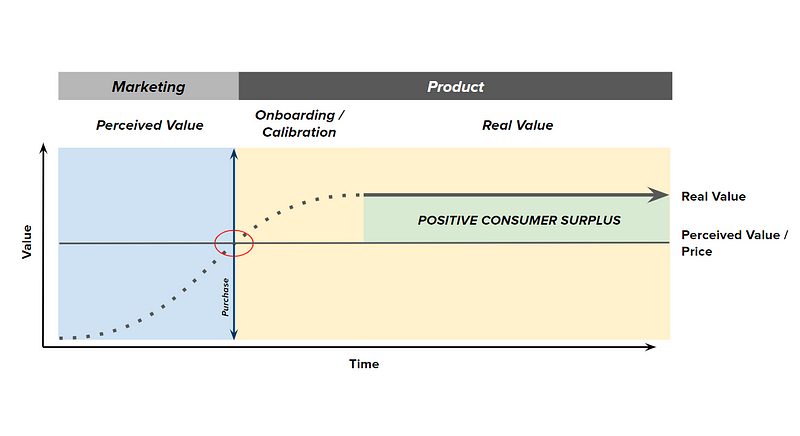

Perceived value is a subjective perception, whereas real value is established through actual engagement with a product, reflecting the actual worth. When perceived value matches real value, customer expectations are fulfilled, and they feel satisfied with their purchase. However, this scenario is seldom encountered. In the following discussion, we will examine two extreme cases where there is a discrepancy between perceived value and real value.

When Perceived Value > Real Value

As we discussed, when perceived value is greater than or equal to price, that leads to (perceived) consumer surplus, driving a customer sale. A problematic situation arises when a customer’s assessment of real value after they start engaging with the product falls below the price they paid (their perceived value). In this scenario, the consumer has a negative consumer surplus and will be disappointed with their purchase. They are at risk of churn.

Signals that you might find yourself having perceived value exceeding real value include high return rates, high early disengagement / cancellation, low customer satisfaction, and feedback that your product is “too expensive”. If you are getting this feedback there is likely misalignment between your product and marketing teams. Here are a few strategies you can take:

Re-calibrate Marketing: Re-evaluate your marketing message to not over-promise to customers. If your product team can’t deliver on your message, you are misleading customers and feeding a leaky bucket.

Invest in Product: If there is high perceived value this means that there is a market for your perceived product. Investing in R&D can help you more fully realize the perceived consumer surplus. Keep in mind though that real value doesn’t magically improve overnight.

When Real Value > Perceived Value

When the real value of a product or service is higher than its perceived value, it indicates that the product is delivering more than what customers expect. This value mismatch can be an opportunity for businesses to improve their pricing and marketing strategies to reach a wider audience. Signs of real value exceeding perceived value include low return rates, high engagement and early expansion, and feedback indicating that the product is “underpriced”.

Pricing Strategies

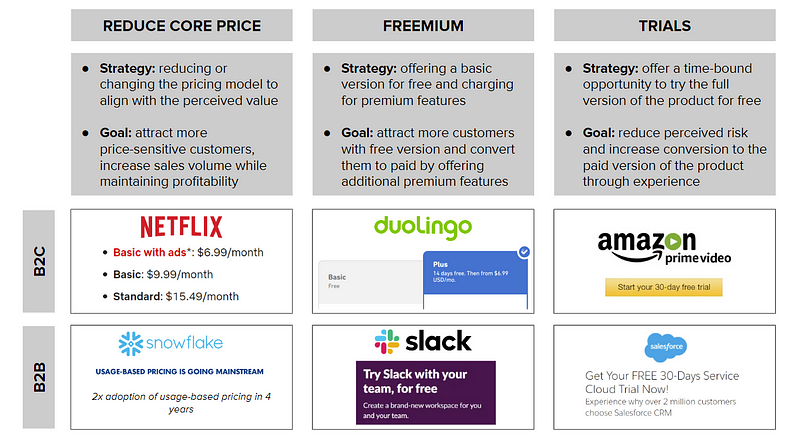

If you find yourself with real value in excess perceived value, beyond more appropriately marketing your product features, there are a few pricing strategies you can also take advantage of aimed at reducing the entry point to engaging with your product: 1) reducing or changing your core pricing model and 2) reducing entry pricing via a freemium offering or trials. By reducing the barrier to entry to using your product, your product now becomes your most powerful marketing channel.

Key Considerations

It is crucial to carefully study each pricing strategy above and choose the appropriate approach for your product or service. Implementing a price reduction without proper consideration of your costs could lead to negative consequences such as worsening economics and a tarnished brand. For instance, Netflix experimented with a free trial but ultimately discontinued it due to the high cost of acquiring new customers and the low conversion rate of free trial users to paying customers. Before implementing any of these pricing strategies, here are a few starter questions to ask:

Reduced Core Pricing:

Will reducing the price of the product still allow the business to maintain profitability?

How will competitors respond to the lower price point?

Will lower pricing negatively impact brand perception or quality perception?

Will lower pricing attract a new customer segment or cannibalize existing sales?

Freemium:

How will the business differentiate the free and premium version of the product?

What features should be included in the free version to encourage users to upgrade to the premium version?

Will the free version cannibalize sales of the premium version?

Trial (Free or Paid):

What features should be included in the free trial to best showcase product value?

How long should the free trial last to give customers enough time to evaluate the product but not so long that they lose interest?

How will the business convert free trial users to paying customers?

If you decide to offer a freemium or free trial service, it’s important to have both (a) low marginal costs and (b) minimal sales and marketing expenses. Because the vast majority of users don’t pay, a freemium company will struggle if its product is expensive to market, deliver, or support.

How to Measure Perceived and Real Value?

In a prior post, I wrote about how to measure willingness to pay via a Van Westendorp pricing survey. It is important to survey three groups: a market panel, current customers, and churned customers. The optimal price for the market panel is the perceived value and the optimal price of your current customers is the real value. If these numbers do not match, it is worth investigating further.

Conclusion

To succeed in a competitive market, companies must have a deep understanding of both perceived and real value and apply the appropriate pricing model that aligns with those values. It is crucial to acknowledge that both perceived and real value are dynamic and can differ from customer to customer, depending on their evaluation of the product or service.

Additionally, cross-functional alignment between product, marketing, and finance is crucial for realizing durable value. Pricing models that misjudge perceived and real value or misalign team incentives can lead to negative impacts on the company’s growth rate and bottom line.

Stay tuned for my next post that goes deeper into real value, highlighting the power of increasing real value over time.

Special thanks to my colleagues Sam Bauman, Ben Katz, and Alec White for reviewing and sharing feedback on this post.

Interested in going deeper? I offer consulting services and can help you think through challenges surrounding growth strategy, pricing, retention, unit economics, defining your a-ha moment, and more. Learn more.